Roth ira calculator 2020

So the idea of rolling your Roth 401k money into a Roth IRA before that magic age makes a. 864 and Notice 2020-33.

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account.

. Heres how a Roth IRA works who qualifies and FAQs. Sometimes FMV and RMD calculations need to be adjusted after December 31. Prior to 112020 an individual could not contribute after age 70½.

Easily calculate your tax rate to. 2020 Distributions from Individual Retirement Arrangements IRAs Fidelity. So you lose the tax-free growth on the money you had to withdraw.

Converting to a Roth IRA may ultimately help you save money on income taxes. The SECURE Act raised the RMD age to 72 from 70 12 but only for those who turned 70 12 in 2020 or later. With a traditional IRA and a Roth IRA the contribution limit is a shared limit you.

The SECURE Act of 2019 removed the age limit at which an individual can contribute to a traditional IRA. This included the first RMD which individuals may have delayed from 2019 until April 1 2020. A qualified HSA funding distribution may be made from your traditional IRA or Roth IRA to your HSA.

First contributed directly to the Roth IRA. Fidelity Personalized Planning. 2021 and the past two tax years 2020 2019.

This calculator helps people figure out their required minimum distribution RMD to help them in. However the Roth 401k earnings arent taxable if you keep them in the account until youre 59 12 and youve had the account for five years. The challenge with relying solely on a Roth IRA conversion calculator is that the assumptions are based on future income tax expectations.

Act in March 2020 allowed for the withdrawal of up to 100000 from Roth or traditional IRAs. Please speak with your tax advisor regarding the impact of this change on future RMDs. Like a traditional 401kand unlike a Roth IRAyou do have to take a required minimum distribution RMD from a Roth 401k unless youre still working for that employer.

Use this Roth IRA calculation method to determine your contribution limits for tax purposes. Retirees who are age 72 or above are required by the IRS to take a minimum distrubtion annually. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD.

The CARES Act passed in March of 2020 temporarily waived required minimum distributions RMDs for all types of retirement plans including IRAs 401ks 403bs 457bs and inherited IRA plans for calendar year 2020. Easily calculate your tax rate to make smart financial decisions Get started. This is one of those issues but only for this yearHeres why.

It is difficult to predict where income tax rates are headed in the next one to two years. Begins to phase out when your modified AGI reaches 124000 if you are single or head of household or 196000 if married filing jointly Is phased out completely when your income is more than 139000 if you are single or head of household or 206000 if married filing jointly. Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears.

To better understand your eligibility use our IRA Contribution Calculator. A Roth IRA conversion has a cost which is the income taxes on the amount you convert. From IRS Publication 590-B.

The IRS has published new Life Expectancy figures effective 112022. If your income is above these amounts our Roth IRA calculator will tell you how much you can contribute. The SECURE ACT of 2019 raised the age for taking an initial RMD to 72 beginning in 2020 for individuals not already 70½ the previous age was 70½.

This calculator has been updated to reflect the new figures. Understand how to calculate when you have to take RMD withdrawals from your 401k. Use a Roth conversion to turn your IRA savings into tax-free RMD-free withdrawals in retirement.

The amount you can contribute to a Roth IRA 2020. A Roth IRA is a retirement account in which after-tax money grows tax-free and withdrawals are tax-free. Like everything else when it comes to RMDs theres always a tax rule twist.

Answer a few questions in the IRA Contribution Calculator to find out whether a Roth or traditional IRA might be right for you. While Fidelity Personalized Planning Advice is not currently designed for investors. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Rolled over a Roth 401k or Roth 403b to the Roth IRA. With a Roth 401kunlike a Roth IRAyou must take a required minimum distribution RMD beginning at age 72 for those born on or after July 1 1949 if youre retired. IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you.

When the value of your investments in a Roth IRA Roth Individual Retirement Account decreases you might wonder if there is a way to write off those losses on your federal income tax return. RMDs every year after you reach age 72 age 70½ if you attained age 70½ before 2020 regardless of whether you actually need the money. If youre under age 59½ and you have one Roth IRA that holds proceeds from multiple conversions youre required to keep track of the 5-year holding period for each conversion separately.

Converted a traditional IRA to the Roth IRA. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. Non-taxed Roth 401k introduced in 2006.

401k required minimum distributions start at age 70 12 or 72. Roth 401ks reduce taxes later. Like tax-deferred 401ks earnings grow tax-free in a Roth 401k.

The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you. Determine the required distributions from an inherited IRA. See also Notice 2020-29 2020-22 IRB.

You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the total contributed to all Traditional andor Roth IRAs totals no more than 6000 7000 for those age 50 and over for tax year 2021 and no more than 6000 7000 for those age 50 and over for tax year 2022. 2022 Retirement RMD Calculator Important. For a Roth IRA you can take a.

The SECURE Act changes the distribution rules for beneficiaries of account owners who pass away in 2020 and beyond. This distribution cant be made from an ongoing SEP IRA or SIMPLE IRA. Roth IRA Conversions and Taxes.

Explore personal finance topics including credit cards investments identity.

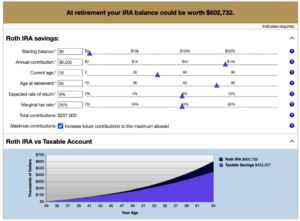

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Roth Ira Calculator Excel Template For Free

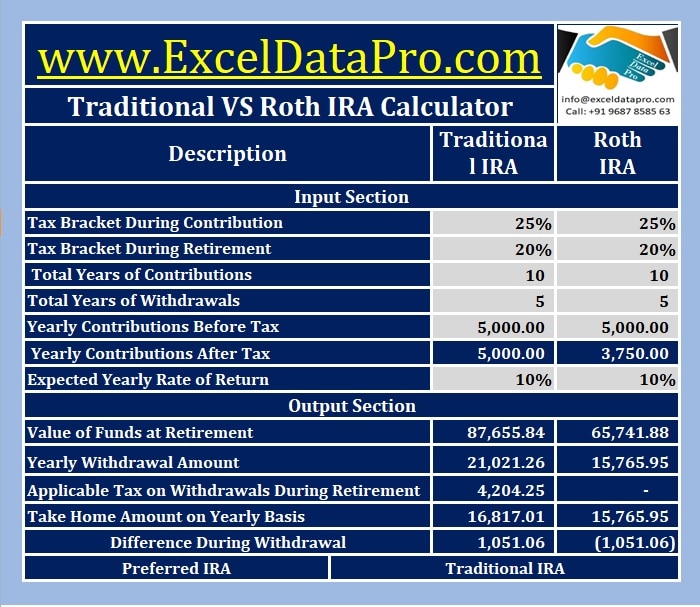

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Calculator Roth Store 59 Off Ilikepinga Com

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Blog What Is The Best Roth Ira Calculator Montgomery Community Media

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

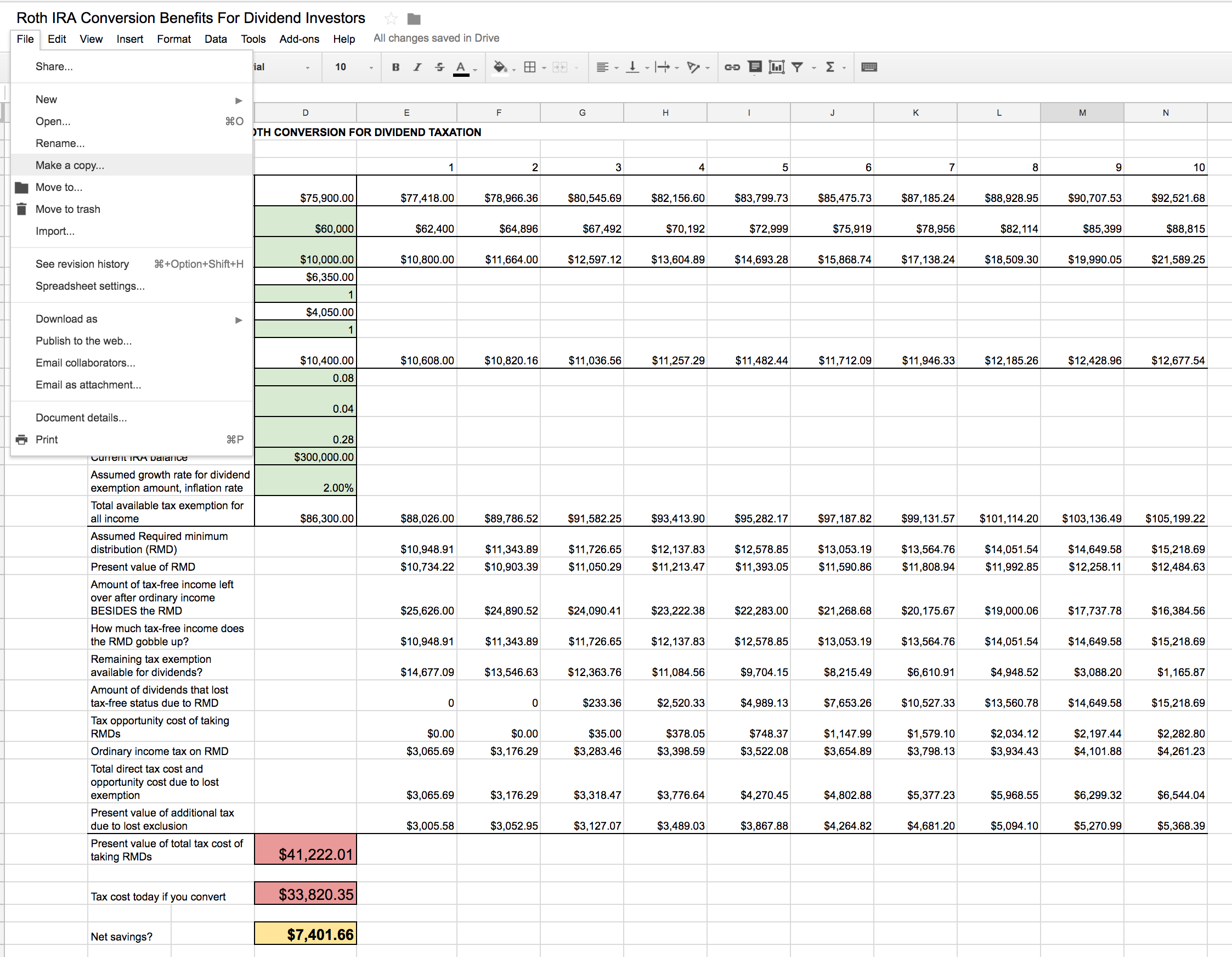

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator